I've always identified strongly as A Person Who Reads A Lot, so I feel like I'm supposed to hate e-readers (Kindles, Nooks and the like) and decry the possibility of the demise of the print book. Now, I will admit to having a great fondness for paper books, especially the smell. I spent many hours at our local library when I was younger - first making my way through their entire stock of The Babysitter's Club as a child, then shelving books as a teenager (which I am terrible at, incidentally - ooh! I should read this one and this one and this one...) and the smell of books always brings me right back. A paper book is also incapable of running out of batteries.

However, I do have a huge emotional attachment to my Kindle - looking at it is like looking at all of my favourite books at once. I've re-read Discworld books, Little Women, Harry Potter, The Hobbit, Sherlock Holmes, Slaughterhouse 5, Dirk Gently, His Dark Materials and countless more on that little machine, as well as reading lots of new books and short stories that have become new favourites. I even persuaded Philip Pullman to sign it!

E-readers vs. tablets

My e-reader was a very welcome birthday present from my dad in 2012. It's a 4th generation Kindle - it's got an e-ink rather than back-lit display, plus wifi for getting new books, but no keyboard or touchscreen, so trying to use the installed browser is futile.

I think this is the perfect combination - it's about as amenable to internet browsing as a real book, but I can still get books delivered to it wirelessly, and it feels like reading paper, not a screen. The battery life is also very, very long.

I've read a lot of books on a laptop screen and even on my phone, but my e-reader makes it far easier to escape the real world.

I think you can buy Kindles from around the £25 mark secondhand on eBay, and Nooks for about £30. Of course I wouldn't recommend buying a Kindle first-hand from Amazon, because they treat their staff terribly and don't pay taxes.

Size

I currently have 230 books on my e-reader. Can you imagine trying to fit those into your hand luggage?

Reading one-handed

What do the following things have in common: indents from the carpet in your elbows, a crook in your neck, and a book falling on your face while you're lying on your back? Answer: they are all dangers inherent in the constant struggle of trying to find a comfortable reading position. You have to shift position at least once an hour to avoid permanently breaking yourself, and eventually you run out of positions.

Once you remove the constraint of having to hold the pages open, however, you open up a whole world of possibilities. My two favourite new positions are lying on my front with a pillow under my chin, and lying on my back with the reader propped up by its case on my stomach.

Font size

I realised a while ago that most of the books I've bought as an adult have had tiny, tiny fonts. In fact, this seems to be a feature of grown-up books in general. Until I had the choice to read with as large a font as I'd like, I never realised how annoying this was. Once you've got a big font, you can sit with your book very far away, which opens up even further comfortable reading positions.

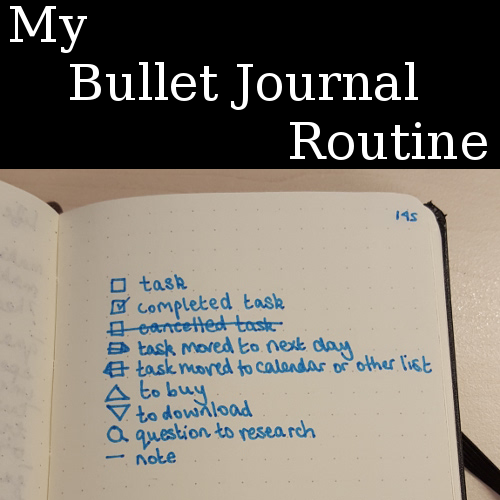

Bookmarks

Things I have previously used instead of bookmarks in real books: receipts, bits of tissue, yarn, sweet wrappers, pens, train tickets and, in dire circumstances, a sock. It is nice not to have to use such ingenuity.

Free books

The utterly brilliant Project Gutenberg offers free ebook downloads of a huge library of out-of-copyright books. Stuck for ideas? How about Jane Austen, Victor Hugo, or Charles Dickens?

The best program for cataloguing your ebooks, converting formats and transferring them to your e-reader is Calibre, which is free and cross-platform.

Magazines

Did you know you can subscribe to magazines on your e-reader?? I discovered Fantasy and Science Fiction magazine a while ago and it's been a source of great entertainment ever since. It comes out every 2 months and costs £1.98 per issue, and it usually contains a mixture of novellas, novelettes and short stories. Once upon a time, it used to publish Isaac Asimov, and now it showcases great contemporary authors. You can also buy it made from paper, but it costs a lot more.

Downsides

There are a lot of obvious downsides: the battery can and does run out occasionally, there are situations where you can't switch them on, you can't read picture books or big coffee table books, and footnotes are a total nightmare. However, as a book lover, my e-reader has had a huge positive effect on my life.